Dear Readers, One figure dominated India’s policy discussions last week: $400 billion. It was the value of all goods exported by India (as of last week) in the current financial year (2021-22 or FY22). To be sure, this number refers to exports of only the goods, and it does not include services. Why was it such big news? For one, this is the highest value of goods that India has ever exported in its history. In fact, by the time the financial year ends — in another three days, this figure is expected to nudge up to $410 billion (see CHART 1). As such, it was natural to find that everyone in the government — from the Prime Minister to the Union Commerce Minister — congratulated all the exporters for achieving this historic feat.

However, the euphoria is hiding more than it reveals.

What does the $400 billion number hide? There are several trends and takeaways that might be ignored if one only focuses on the $400 billion number. 1. Low levels of exports as a percentage of GDP The first thing that a $400 billion figure hides is relatively low levels of exports relative to the overall GDP (see CHART 2). In absolute terms, India’s merchandise exports had reached the $305 billion mark in 2011-12 itself. At that time, it was 17% of India’s GDP. Since then, they have fluctuated between a low of $262 billion (in 2015-16) and $330 billion (in 2018-19). But all this while, India’s overall GDP kept going up. The relative weakness of India’s export performance can be seen either as the stagnation of the line graph in CHART 1 or the decline in the line graph in CHART 2.

By itself, the $400 billion mark for exports would have been achieved long back had India’s export kept pace with its GDP growth. 2. Low base effect Beyond the fact that this was the historic best — the previous high was $330 billion in FY19 — what made this surge in exports even more relevant was the fact that it is coming after two years of contraction. These included not just the FY21 (when Covid first disrupted the global economy and India’s goods exports contracted by over 7%) but also, and more importantly, FY20 (when Covid could not be blamed for India’s dismal performance and India’s goods exports had shrunk by over 5%). The spectacular (nearly) 49% growth in exports in the current year (data based on April to January period as yet) thus has to be seen this context. Something similar had happened in the immediate aftermath of the Global Financial Crisis of FY09 (see CHART 3). After growing at double-digit rates during FY03 and FY09, India’s goods exports contracted by 3.5% in FY10. But the very next year, in FY11, they shot up by around 41%.

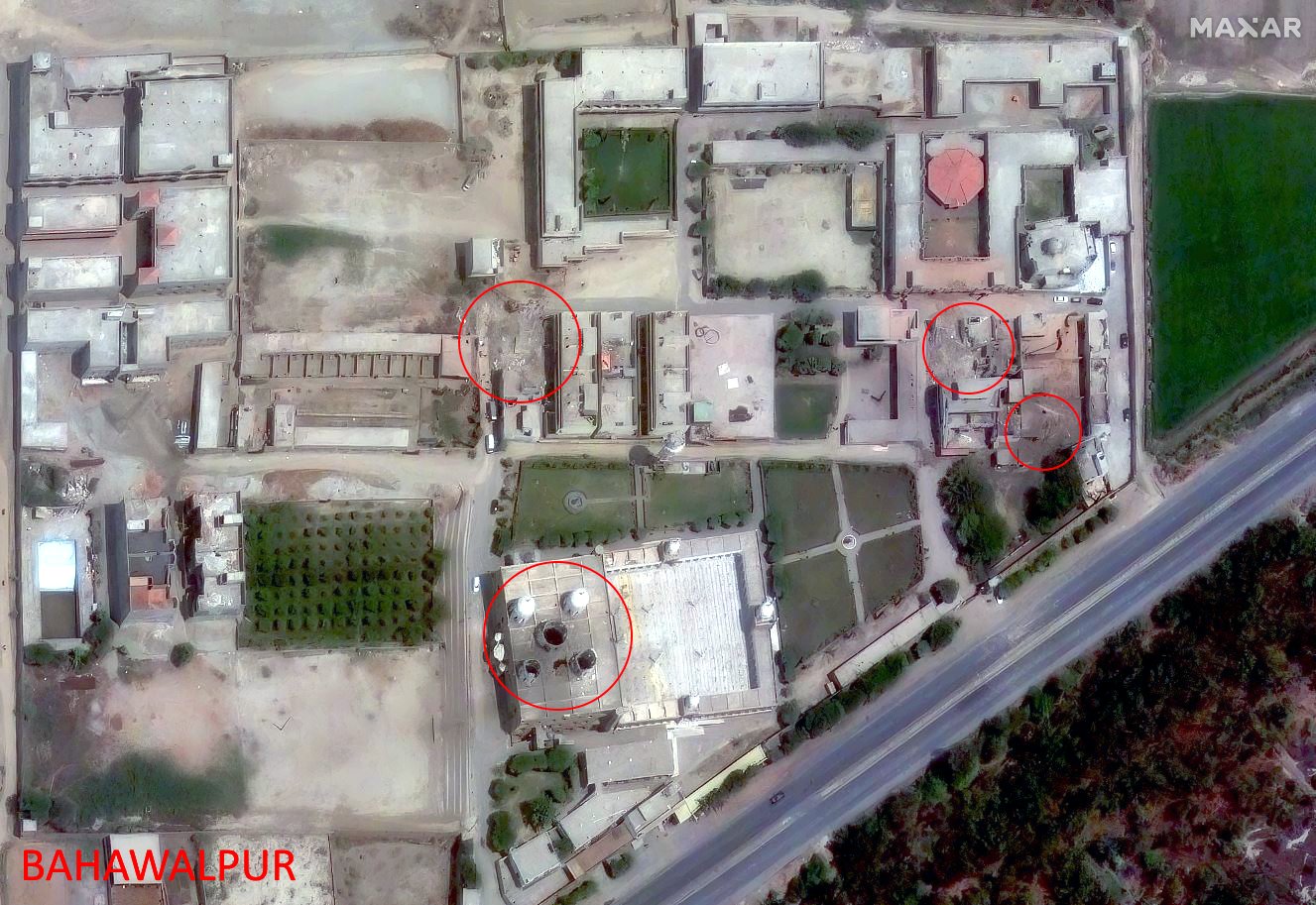

3. An outlier in the recent trend? Even so, as CHART 3 (above) shows, since FY12, the growth rate of India’s exports had largely stagnated, albeit with fluctuations. In the past 10 financial years, India’s exports have contracted on five occasions. More crucially, unlike in the high growth phase during the first decade of this century, recovery wasn’t as sharp. This year’s sharp recovery is thus an outlier and begs the question whether it is an outlier in the recent trend. This doubt is strengthened by three additional observations that are mentioned next. 4. Not a broad-based recovery Look at TABLE 1. It provides information for all the commodities that India exports, along with their share (in total export basket) as well as their individual growth rates.

Of the 20 commodity groups, only six (highlighted by red circles) had a growth rate higher than the overall average (49%). Within these six, two had insignificant shares. In other words, most of the commodity groups grew at a rate lower than the overall average. This included some of the biggest sectors (in terms of their share in overall exports) such as Chemicals and products, which is the second-biggest export item. It grew by 17%. Similarly, agriculture, with a share of 9%, grew at just 20% — less than half the overall growth rate. For any commodity group, the implication of growing at a rate lower than the overall average is that its share in India’s export basket would have reduced relative to the previous year. 5. Was the growth a result of an increase in value or volume? In any year, the value of India’s exports could go up for three reasons: Prices of exported goods are going up (while the total volume exported remains the same), volume went up (while the price of all exports remained the same) or, and most likely, a combination of both volume and prices going up. But the $400 billion figure essentially refers to the value of exports. It doesn’t say anything about the contribution of volume increase. For instance, India’s biggest export item was petroleum and petroleum products — accounting for 15% of total exports — and their value grew by a whopping 158% (more than three times the overall average rate). And this has happened in a year when crude oil prices have steadily gone up. 6. Growing worries over global growth, inflation and demand for India’s exports The government has asserted that this jump in exports is a result of “a detailed strategy”, which targeted specific countries for specific exports and made the necessary “course correction”. Indeed, this must be true. Something had indeed changed this year otherwise India’s exports would not have jumped so sharply after contraction — quite unlike most years in the past decade. However, it is also quite likely that, apart from domestic policy focus, India’s exports received a boost from a surge in global demand. This, in turn, happened for two reasons. One, the overall economic recovery in the developed world was quite sharp, fuelled by massive spending by governments in those countries. Two, most central banks in the developed world practised a very loose monetary policy; this meant credit was plentiful and cheap. But, as the current financial year comes to an end, this global demand is headed for a reality check.

Most estimates expect global economic growth to lose steam, and rather significantly (see CHART 4 above). This aggregate deceleration is broad-based, with most of the major economies facing downgrades (see CHART 5).

Lower growth rates are coupled with higher inflation rates (see CHART 6). The data for Charts 4 to 6 is sourced from the latest Global Economic Outlook from Fitch Ratings that was released last week.

Between the pincer effect of lower growth and higher inflation (which reduces people’s purchasing power), the global demand for Indian goods is most likely to suffer in the coming year. That’s it on exports. Another key concern these days is inflation. Watch the latest episode of The Express Economist to understand why higher prices are here to stay. The second part of this episode will be out on Monday at 6 pm. Make sure you watch it not just to understand what can be done to control inflation but also if, unlike common people, the government benefits from high inflation! Stay safe Udit If you received this newsletter as a forward, you can subscribe to it, here. Do read our other Explained articles, here | To subscribe to our other newsletters, click here |

No comments:

Post a Comment